Over the last several years, many traditional financial institutions and brokerage firms, such as Charles Schwab and TD Ameritrade, have moved away from allowing clients to use a Self-Directed Solo 401(k) plan to make alternative asset investments. The intent behind their decision likely is fueled by their inexperience working with retirement plans that have interests in such classes. IRA Financial has helped hundreds of these clients who have been told by their brokerage firm that they could no longer maintain a Solo 401(k) account and must move the plan to another institution.

This article will describe the procedures involved in moving a Solo 401(k) from TD Ameritrade or any other brokerage firm to another institution. Moreover, it will explain the different types of Solo 401(k) plans, as well as detail the primary advantages of establishing one.

- Learn why TD Ameritrade is not the best place to start a Solo 401(k)

- If you want full control of your retirement plan, you must self-direct it

- IRA Financial is the best place to open a Solo 401(k); Learn how to move your plan over

What is a Solo 401(k)?

The Solo 401(k) plan, also known as an Individual 401(k) or Self-Directed 401(k) is an IRS-approved plan that was designed specifically for the self-employed or small business owner with no employees other than the owners(s).

Not All Solo 401(k) Plans are the Same

When it comes to deciding what type of Solo 401(k) plan is best for you and your business, it is important to look at all the options the plan provides to make sure it will satisfy your retirement planning, tax, and investment goals.

Most banks and financial institutions, such as TD Ameritrade, offer Solo 401(k) plans. These plans are typically quite restrictive and only permit the plan participant to make limited investments without benefiting from most of the available IRS-approved options such as the loan and Roth features. In addition, brokerage firms have, in the past, allowed clients with a Solo 401(k) to open an account and use their brokerage services. Unfortunately, TD Ameritrade, as well as many other popular brokerage firms, have begun forcing Solo 401(k) plan clients to find another custodian for their plan.

The reason is not well understood, but its likely centers around the fact that most traditional brokerage firms do not feel comfortable serving as the plan custodian that contains alternative assets. Thankfully, there are companies, such as IRA Financial and others, which will serve as the custodian for your Self-Directed Solo 401(k) plan.

Transferring a Solo 401(k) Plan Tax-Free

A Solo 401(k) plan is adopted by the employer. Unlike a Self-Directed IRA, the plan documents control the operations the plan can do, such as the type of investments, loan option, Roth contribution option, and much more. A Solo 401(k) plan can be transferred from one brokerage firm or custodian to another, tax-free. Such a transfer is not treated as a taxable transfer or rollover, much like an LLC moving funds from one bank to another under the LLC name.

For example, if a Solo 401(k) client of IRA Financial opened an account with TD Ameritrade and now wanted to move the plan funds to Fidelity, the client would just need to open a new plan there and move the funds. The problem arises when one acquires a plan from a brokerage firm, which is often free, and now wants to move that plan to another brokerage firm. In such a case, the employer would need to open a new Solo 401(k) plan account and will likely need to treat it as a new plan since there is a new plan document.

This issue does not arise when one acquires a Solo 401(k) plan from a plan document provider, such as IRA Financial, since one is bringing his or her own Solo 401(k) plan to the brokerage firm. Whereas, if the employer acquires the plan document directly from the brokerage firm, the plan documents belong to the brokerage firm and not the employer.

Transferring a TD Ameritrade Plan to IRA Financial

If one has a TD Ameritrade Solo 401(k) plan and is being required to close the account and move the plan funds, the individual can open a Solo 401(k) with IRA Financial. The plan assets can be moved tax-free. IRA Financial would be responsible for the plan documents and would assist with all annual IRS administration, something TD Ameritrade does not do. Once your IRA Financial Solo 401(k) plan is established, you can invest in alternative assets directly with IRA Financial or you may open a brokerage account.

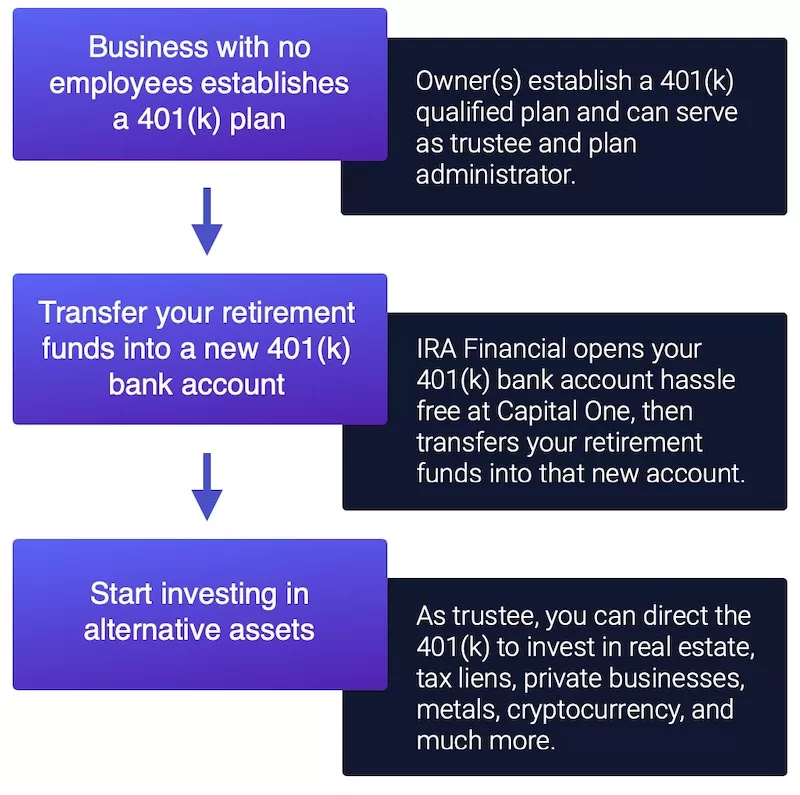

How to Open a Solo 401(k) Plan with IRA Financial

How Involved is IRA Financial?

Once IRA Financial has funded the Solo 401(k), you, as trustee of the plan, will have 100% control over the plan assets. At that time, IRA Financial is no longer involved in the investment, but we continue to be responsible for all IRS reporting regarding your plan.

The IRA Financial Solo 401(k) Plan

The IRA Financial Solo 401(k) plan is unique and popular because it is designed explicitly for small, owner-only businesses.

Unlike a TD Ameritrade Solo 401(k) plan, IRA Financial’s offering will allow one to invest in traditional, as well as alternative assets, such as real estate or cryptos.

Tax-Free Loan: The IRA Financial Solo 401(k) plan allows plan participants to borrow up to $50,000 or 50% of their account value (whichever is less) for any purpose. The loan must be paid back over a five-year period at least quarterly at a minimum interest rate of Prime (you have the option of selecting a higher interest rate).

Checkbook Control: The most significant advantage of the IRA Financial Solo 401(k) plan versus the TD Ameritrade plan is that it offers you checkbook control over your retirement funds. At TD, one is relegated to making traditional investments, such as stocks and or mutual funds. In addition, the plan account is required to be opened at TD Ameritrade.

With the IRA Financial Solo 401(k) plan, the plan account can be opened with IRA Financial as well as many local banks. Plus, the plan participant can make almost any traditional as well as non-traditional investments, such as real estate, precious metals, cryptos, third-party lending, notes, stocks, private business, and much more. You have the freedom to make the investments you want as trustee of the plan.

Easy Administration: There is generally no annual filing requirement unless your plan value exceeds $250,000 in assets. You would then need to file a short information return with the IRS (Form 5500-EZ). Unlike TD Ameritrade, however, the tax professionals at IRA Financial will assist you in completing this form is required

No Tax on Real Estate Financing: Since TD does not allow real estate investments, one would not be able to benefit from the ability to use nonrecourse financing, tax-free, when making real estate investments with Solo 401(k) retirement funds. With IRA Financial, you can utilize arguably the best retirement plan for real estate investors.

Conclusion

For those TD Ameritrade Solo 401(k) plan clients who are being compelled to close their plans, you have options! Simply open a Solo 401(k) plan with IRA Financial and move the plan funds tax-free to us. With our plan, you will gain the ability to invest in alternative assets directly with us, while also gaining the ability to invest in stocks via a brokerage account. Plus, the IRA Financial tax professionals will assist you with the administration of your Solo 401(k) plan. Get started today!