Ethereum

Ethereum, launched in 2015, is now the second most traded cryptocurrency in the world. More than just being another cryptocurrency, it’s a decentralized software platform that enables Smart Contacts and Distributed Applications (ĐApps) to be built and run without any downtime, fraud, control or interference from a third party. Ethereum on its platform-specific cryptographic token, commonly known as Ether. Ether works like a vehicle, moving funds around on the Ethereum platform. It is highly desired by developers who want to develop and run applications inside Ethereum. According to Ethereum, Ether can codify, decentralize, secure, and trade just about anything.

The Ethereum Merger

The way Ethereum fundamentally works has changed. Since 2020, there have been two versions of Ethereum running in parallel. One has used the traditional method of recording transactions, while the other relied on a new method. Late this year, the two versions merged into one, adopting a new record-keeping paradigm.

In September 2022, Ethereum switched from requiring highly energy-intensive technology to mine it to a more sustainable system in a major update called “the merge.”

This technological overhaul of the world’s second-most valuable cryptocurrency by market cap was years in the making, and it didn’t take anyone by surprise. That being said, change breeds uncertainty and uncertainty can roil markets.

With the implementation of the Merge, blocks of new transactions went from being verified by computers solving massively difficult math problems to a system that uses financial incentives and penalties to accomplish the same task. This change is estimated to reduce the network’s power consumption by more than 99.95%.

But this change goes far beyond power saving. Mainnet, the original blockchain used since Ethereum’s inception in 2015, used a system called proof-of-work to securely transmit new transactions and other information. Proof-of-work requires user computers to solve incredibly difficult computations before being allowed to add a new block, thereby earning crypto rewards.

This method, commonly known as mining, is required by most cryptocurrencies, including Bitcoin. Mining is secure, but it’s also energy intensive. Before the Merge, Ethereum network consumed as much energy as some countries.

Proof-of-stake is an alternative that consumes less energy. Instead of devoting electricity, which fuels computing power, users themselves become part of the verification process by putting their own personal cryptocurrency on the line in a process called staking.

These users, called validators, are randomly selected to verify new information to be added to a block. They receive cryptocurrency if they confirm accurate information. If they act dishonestly, they stand to lose their stake.

How to Buy Ethereum in a Self-Directed IRA

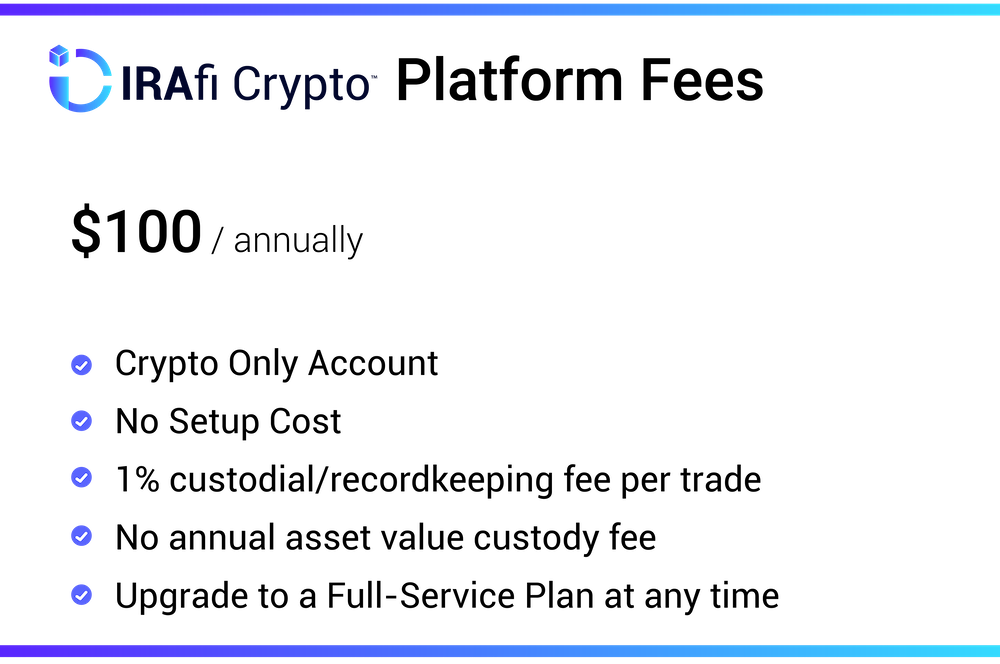

The IRAFI Crypto™ platform brings together the leading self-directed retirement provider with a leading regulated crypto exchange to remake and enhance the self-directed retirement account crypto industry. Powered by Bitstamp, a global cryptocurrency leader, retirement account investors can now buy, sell, or hold cryptocurrency, such as Ethereum, via the IRA Financial app or website quickly, easily, and cost-effectively.

The IRAFI Crypto™ platform is a dedicated platform for crypto traders. The platform will offer all retirement account owners the ability to invest in the major cryptocurrencies offered by the Bitstamp exchange, including Bitcoin, Ethereum, XRP, and much more with no annual custody asset holding fees. IRA Financial clients will be able to buy and sell cryptos 24/7 instantly or via a limit trading feature. The platform is available on Apple, Android & desktop. Cryptocurrency prices are updated in real-time with historical data on each coin, including total value & profit/loss at a glance.

Can You Explain Ethereum & Crypto Currency Investing?

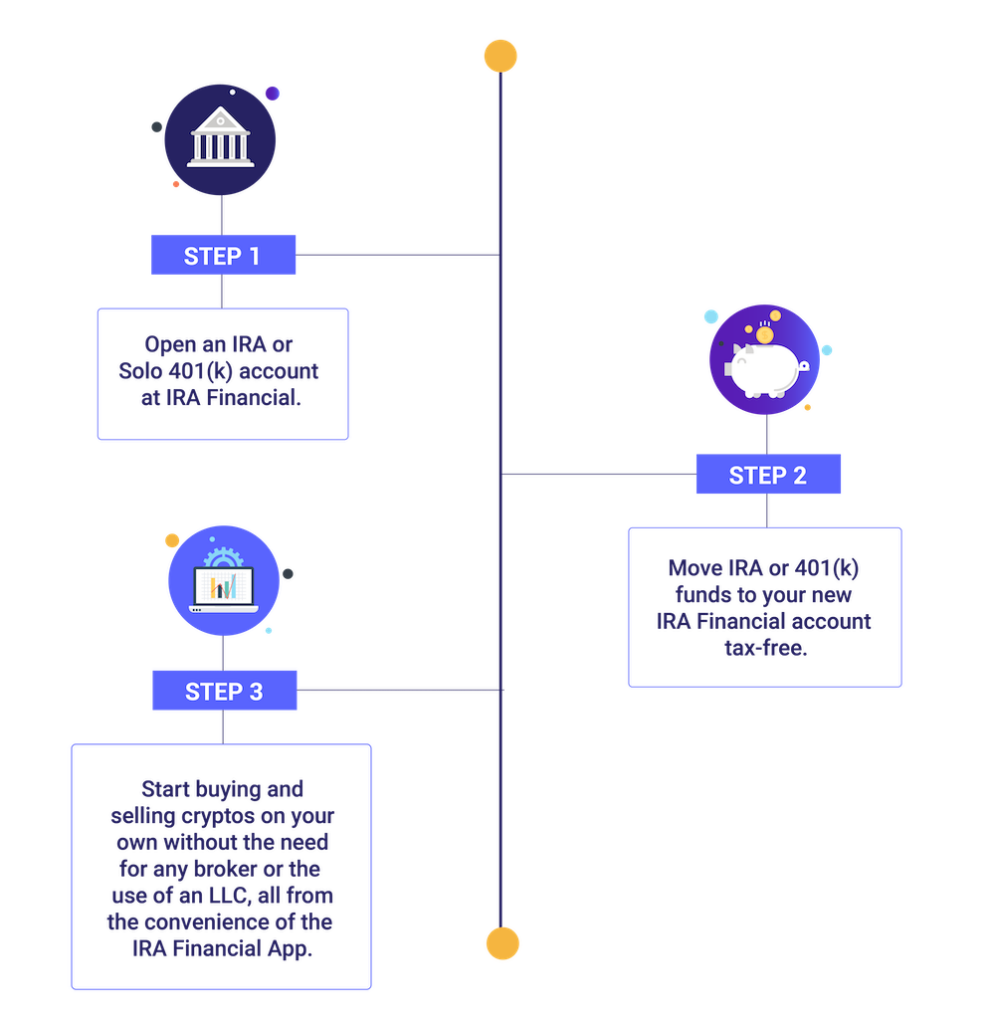

We are very proud to have the industry’s best solution for buying Ethereum and other major cryptocurrencies on an exchange in the name of an IRA or 401(k). IRA Financial was the first Self-Directed IRA company to allow their clients to invest in cryptocurrencies, such as Bitcoin or Ethereum, directly via a cryptocurrency exchange without the need for a third-party broker or the use of an LLC. Now, investors can use their retirement funds to buy all the major cryptocurrencies directly through Bitstamp, one of the leading US cryptocurrencies exchanges. The IRAFI Crypto™ Platform is unique because it allows retirement holders to hold Ethereum in an IRA directly on an exchange. The account is opened in the name of the IRA but controlled by you as the authorized representative on the account. The IRA holder has 100% control over the account and can trade anytime.

Why Bitstamp?

Bitstamp is the oldest and most reputable cryptocurrency exchange in the industry and has been operating since 2011. Bitstamp is regulated by the New York State Department of Financial Services (NYDFS). Bitstamp uses 2FA, SSL encryption, and cold storage for most of their crypto holdings, and has a dedicated security team working around the clock to prevent and respond to security attacks.

What type of retirement accounts can be used to buy Ethereum with the IRAFI Crypto™ Platform?

Any IRA, Roth IRA, SEP IRA, SIMPLE IRA, HSA, Coverdell, a solo 401(k) plan, or defined contribution plan (401(k), 403(b), 457(b)), so long as you have access to those funds. In the case of a defined contribution plan, if you are seeking to use funds from an employer plan where you are currently employed, you will generally need to be over the age of 591/2 to get tax-free access to those funds. Note – any defined contribution plan funds from a former employer can be rolled into an IRA tax-free and invested in cryptos, such as Ethereum, through the IRAFI Crypto™ platform.

Do I control my IRAFI Crypto™ account that owns Ethereum?

Yes – 100%. You are the authorized representative on the account and total control over all aspects of the IRAFI Crypto™ account on the exchange.

How Does the IRAFI-Ethereum Crypto Solution Work?

With this Ethereum IRA direct solution, you control the purchase and sale of the cryptocurrencies) yourself. In other words, you do not need a costly broker or LLC to facilitate any transaction. In addition, the cryptos will be held in the name of the IRA custodian making everything cleaner from a tax reporting perspective.

Advantages of IRAFI Crypto to Hold Ethereum in a Retirement Account

- No requirement to use broker.

- No requirement to use LLC.

- Ability to buy, sell, or exchange cryptocurrencies

atanytime through a PC or mobile application. - Low, annual flat rate IRA custodian fee, without any asset valuation fees.

Can I Hold Ethereum in a Self-Directed IRA on a Cold Wallet/Off Exchange?

Every cryptocurrency wallet has a public and private key. A cryptocurrency is a digital currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

A cryptocurrency public key is used to receive funds. The public key identifies your crypto A public key allows you to receive a cryptocurrency transaction. Whereas, a crypto private key is only used to sign transactions and prove you own the related public key. A private key is a large, arbitrarily generated string of alphanumeric characters with hundreds of digits.

Ethereum IRA & Cold Wallets

Most crypto investors are not aware that when purchasing cryptos on a centralized exchange, such as Coinbase, the cryptos acquired are automatically stored in your exchange-hosted wallet, which is generally custodial controlled. In other words, the exchange has control of your crypto private keys, which means that you do not control the underlying crypto. Therefore, the phrase “no keys, no cheese” has become such a popular slogan for traditionalist crypto investors. Since the fallout of FTX and several other crypto exchanges which caused millions of crypto investors to lose control of their cryptos, more and more crypto investors are seeking to control their crypto private keys in order to secure ownership of the crypto.

How to Hold Your Ethereum Private Key on a Cold Wallet?

In general, there are numerous ways to control one’s Ethereum private keys. An Ethereum token private key can be stored on a hot or cold wallet. Hot wallets are connected to the internet while cold wallets are not. Most people who hold digital assets have both cold and hot wallets because they are designed for different purposes. A cold wallet is a tool that stores Ethereum and other cryptocurrencies offline (looks like a USB thumb drive). To keep Ethereum offline in a cold wallet means to reduce the threat of their abduction by hackers. If one is using a cold wallet, it is important to remember to keep the wallet somewhere safe and remember your password!

Other than precious metals or coins, which are tangible assets, there are very few tangible assets that can be purchased by a retirement account. For example, case law is clear that an IRA owner can take possession of a stock certificate or real estate deed, which is tiled in the name of the retirement account. However, the emergence of digital assets, such as cryptos, presents a new and unique case where an asset is intangible but can be held tangibly. For example, a crypto coin, such as Ethereum, which is an intangible asset, can also be held in a physical cold wallet. There is currently no direct IRS guidance on whether a retirement account owner can take possession of a digital asset, however, a recent tax court case offered some insight as to the extent to which a retirement account owner can take greater control over an IRA asset.