Solo 401(k)

The best retirement plan for the self-employed or small business owner with no full-time employees.

What is a Solo 401(k)?

A Solo 401(k) is a retirement plan specifically designed for self-employed individuals. It is not a new type of retirement plan, but essentially a 401(k) plan designed for a business with no full-time employees other than the owners and their spouses. Also known as a one participant 401(k), it works the same as an employer-sponsored plan, but with greater flexibility. To be eligible, you need to satisfy two requirements: the presence of self-employment activity and the lack of full-time employees. You can make contributions as both an employee and employer. Any business with no full-time employees other than the owners or their spouses can establish a Solo 401(k), such as a sole proprietor, LLC, C Corporation, S Corporation, partnership, or charity.

IRA Financial offers an open-architecture Solo 401(k), giving your the opportunity to take advantage of all plan options. These include a Roth sub-account, a loan feature, and the ability to invest in alternative investments, such as real estate, precious metals, and private lending. It’s arguably, the best plan for the self-employed and owner-only businesses with easy administration.

Solo 401(k) Benefits

Maximize Contributions

Make annual contributions up to $70,000 or $77,500 if age 50 or older in Roth, pretax, or after-tax.

Borrow up to $50,000

Borrow up to $50,000 or 50% of your account value (whichever is less) and use your Solo 401(k) loan for any purpose.

Get Checkbook Control

Serve as trustee of your plan and make alternative asset investments on your own with checkbook control.

Hassle-Free Administration

Easy to operate and administer. There’s generally no annual filing requirement unless your account exceeds $250,000 in assets.

No Hidden Fees

Invest for one low flat fee, with no transaction fees, asset valuation fees, or minimum balance requirement.

Real Estate Investor Bonus

Leverage your 401(k) plan to invest in real estate and pay no UBTI tax.

The IRA Financial Difference

24,000+ clients

Our tax and ERISA experts have helped over 24,000 clients in all 50 states.

No hidden fees

No transaction or asset value fees. No minimum balance requirement (with credit card on file).

Serve as your custodian

Hold over $3.2 Billion in alternative assets.

Expertise

IRA Financial’s founder, Adam Bergman, is the author of nine books on self-directed retirement.

Dedicated support

Get direct access to a self-directed retirement expert to establish your plan.

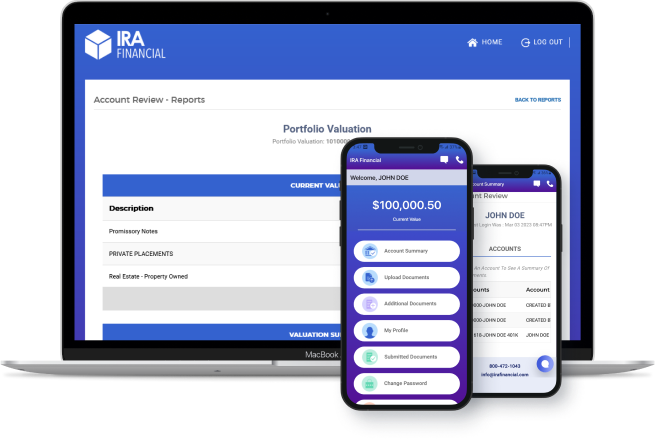

Technology

Use our app to set-up and maintain your account.

Open a Solo 401(k)

Complete your application

Once completed, it will go into a queue to be reviewed (generally, 3-5 days).

Application is reviewed

Your application is reviewed to ensure everything is filled out correctly

Account number assigned

Once your application is approved, an account number is assigned and emailed to you (an additional 3-5 days).

Fund your account

You can now fund your Solo 401(k) via transfer, rollover, or direct contribution.

Start investing

Once your 401(k) is funded, you can begin making investments!

Endless investments opportunities.

Real Estate

Whether it’s residential or commercial, rental properties or raw land, real estate is the #1 alternative investment among retirement investors.Precious Metals

Metals Metals and coins have long been used as a hedge against a volatile economy – just make sure they are IRS-approved precious metals and not held personally.Private Placements

Placements Investment opportunities offered to a select group of high net worth or institutional investors that have reduced risk and assured returns.

Tax Liens/Deeds

Tax liens and deeds allow for exposure to the real estate market in your portfolio without having to invest in the properties themselves.Investment Funds

Hedge funds and private equity fund investments are generally for more sophisticated, accredited investors.

Quick FAQ & Further Reading

Maximum Contribution limits for a Solo 401(k) plan are as follows:

- 2024: Employee Deferrals (under age 50): $23,000

- 2025: Employee Deferrals (under age 50): $23,500

- 2024: Employee Deferrals (age 50 or older): $30,500

- 2025: Employee Deferrals (age 50 or older): $31,000

- 2024: Max Aggregate Contribution Amount (Employee Deferrals + Employer Contributions) (under age 50): $69,000

- 2025: Max Aggregate Contribution Amount (Employee Deferrals + Employer Contributions) (under age 50): $70,000

- 2024: Max Aggregate Contribution Amount (Employee Deferrals + Employer Contributions) (age 50 or older): $76,500

- 2025: Max Aggregate Contribution Amount (Employee Deferrals + Employer Contributions) (age 50 or older): $77,500

To be eligible for a Solo 401(k) plan, you must meet two eligibility requirements: the presence of self-employment activity and the absence of full-time employees. Solo 401(k) eligibility includes the presence of “self-employment activity.” This generally refers to the ownership and operation of: A sole proprietorship, Limited Liability Company (LLC), C Corporation, S Corporations and Limited Partnership where the business intends to generate revenue for profit and make significant contributions to the plan.

Self-employment activity can be part time, and it can be ancillary to full time employment elsewhere. A person can even participate in an employer’s 401(k) plan in tandem with their own Roth 401(k) retirement plan. In such a case, the employee elective deferrals from both plans are subject to the single contribution limit. There are no established thresholds for: profit the business must generate, how much money must be contributed to the plan, when and how quickly the profits and contributions must occur

Unlike a regular 401(k) plan, a Solo 401(k) retirement plan can be implemented only by self-employed individuals or small business owners with no other full-time employees. Additionally, they must not be employed by any business owned by them or their spouse. An exception applies if your full-time employee is your spouse. The business owner and their spouse are technically considered “owner-employees” rather than “employees”.

In order to maintain Solo 401(k) eligibility, the following types of employees may be generally excluded from coverage: employees under 21 years of age, employees that work less than 1,000 hours annually, union employees, nonresident alien employees

Do you have full-time employees aged 21 or older (other than your spouse)? Do your part-time employees work more than 1,000 hours a year? If yes, you must typically include them in any plan you set up. However, a business eligible for the plan can have part time employees and independent contractors.

*Did you know that individuals who participate in the Gig economy are eligible for a Solo 401(k)? Learn more about different side-jobs individuals can do to open a Solo 401(k).

If your spouse is involved in the business and earns compensation from it, he or she can contribute to the Solo 401(k) plan. Your spouse can make separate and equal contributions essentially doubling the annual amount you can contribute.

The IRS only describes what types of investments you cannot make with a Solo 401(k). These include collectibles, such as art, and any transaction that involves a disqualified person. Note: Unlike an IRA, you can invest 401(k) funds in life insurance (on a limited basis).

Many individuals open a Solo 401(k) to save for retirement. Some individuals have traditional jobs and pay into a regular 401(k) or IRA and a Solo 401(k). One of the benefits of opening a Solo 401(k) is the ability to save more! Employer sponsored 401(k)’s are limited by lower annual contributions. Individuals can open a Solo 401(k) to put more money away and diversify their retirement portfolios. Furthermore, opening a Self-Directed Solo 401(k) will allow you to invest in traditional and alternative investments. With IRA Finacial’s Solo 401(k) plan, you can invest in stocks, bonds, and mutual funds. In addition, you can invest in alternative investments to help diversify your portfolio. Popular alternative assets include: Real Estate, Bitcoin, Foreign Currencies, Gold and Precious Metals, Privately Owned Companies/Pre IP Companies, and Traditional Investments including Stocks and Bonds.

There are countless opportunities to diversify your retirement account with a Solo 401(k). While some of the investments you can make are listed above, the options are endless. Instead, with a Solo 401(k) there are only three things you cannot invest in. Best of all, you can open a Self-Directed Solo 401(k) without every stepping foot in the bank.

IRA Financial Group is the only company where you can set up a Solo 401(K) directly from our mobile app. That means you can do everything from our app, set up and account, fund the account, invest, and establish a Solo 401(k). It’s very simple to set up. All you need to do is set up an account with IRA Financial, roll over funds into your new Solo 401(k) account or make an initial contribution. And then as trustee, you’ll have checkbook control so you can make alternative assets like real estate or even traditional investments like stock directly from your account. IRA Financial is the only Solo 401(k) custodian that has a special relationship with Capital One. You’re able to open the account directly from our app, never leave your house, no need to ever go to a bank.

An IRA cannot engage in a transaction with a disqualified person; these include you (the IRA Owner), your spouse, any lineal descendants or ascendants (parents, grandparents, children, grandchildren), their spouses, and any entity where a disqualified person owns more than 50%.

A required minimum distribution (RMD) is the amount you must withdraw from your Solo 401(k) once you reach age 73. The amount is generally about 3% of the total account balance. Unlike a Roth IRA, Roth 401(k) plans are subject to the RMD regime.

Unlike an IRA, you can borrow money from your 401(k) plan. You may take a Solo 401(k) loan of up to $50,000 or 50% of your account balance – whichever is less. The loan must be paid back with a frequency of no less than quarterly. If you fail to pay back the loan, it will be treated as a taxable distribution, and penalties may apply if you are under age 59 1/2.

Because a Solo 401(k) is a tax-advantaged retirement account, there is no tax return due. However, if you have more than $250,000 in the plan, a short, informational return, called Form 5500-EZ, must be filed annually.

The major benefit of using a Solo 401(k) to make a real estate investment is that it is exempt from the UBTI tax. Therefore, you can use leverage (borrowing money) to purchase real estate, and not be subject to tax. The UBTI tax does apply to IRA real estate investments that use non-recourse financing.

The Roth Solo 401(k) plan is basically a regular Solo 401(k) plan with a Roth feature. It combines features of the traditional Solo 401(k) with features of the Roth IRA. A Solo 401(k) plan with a Roth feature allows one to make Roth contributions of up to $23,500 or $31,000 if at least age 50 for 2025.

Unlike pretax plans, contributions to a Roth Solo 401(k) are not tax deductible, however, so long as the Roth account is opened at least five years and the plan participant is over the age of 59 ½, all distributions would be tax free. At age 59 ½, you may be able to live off your Roth Solo 401(k) retirement funds tax free; or keep investing: take out a portion of your funds for any investment purpose, whether it be business or personal without paying one dollar in tax

If you are looking to “supersize” your Roth holdings, you can contribute after-tax money, on a dollar-for-dollar basis to your Solo 401(k) up to the annual limit. You can then immediately roll over those funds to a traditional IRA and then convert it all to a Roth IRA and enjoy a tax free retirement!