Using a Roth IRA to buy real estate is the ultimate tax solution for real estate investors. The reason is that with a Roth IRA, all income and gains from the Roth IRA will flow back to the Roth IRA without tax. Furthermore, so long as the Roth IRA owner is over the age of 591/2 and the Roth IRA has been open for at least 5 years, all Roth IRA distributions are tax-free.

This article will explain what a Roth IRA is and some of the investments and tax advantages of using a Roth IRA to buy real estate. The article will further illuminate the different ways one can use a Roth IRA to buy real estate.

What is a Roth IRA?

The Roth IRA was created by Senator Roth in 1997. No deduction is allowed for contributions to a Roth IRA, but qualified distributions are excluded from gross income. This no-deduction, no-income regime is the opposite of that for traditional IRAs, contributions to which are deductible (within limits), but distributions from which are fully taxed.

Roth IRA vs Traditional IRA

In general, a Roth IRA looks a lot like a traditional contributory IRA because annual contribution limits are the same. However, the Roth IRA differs from a traditional IRA in several important areas. Firstly, none of the contributions to your Roth IRA are ever deductible on your tax return. Moreover, your ability to make a Roth IRA contribution begins to phase out when your adjusted gross income (AGI) exceeds $240,000 (for joint filers) and $161,000 for single filers for 2024.

Note: with a traditional IRA you may contribute even if your income is high and you are covered by an employer’s plan. However, you may not be able to deduct the contribution on your return.

The main advantage of a Roth IRA is that if you qualify to make contributions, all distributions from the IRA are tax-free. Furthermore, unlike traditional IRAs, you may contribute to a Roth IRA for as long as you continue to have earned income.

Why Buy Real Estate with a Roth IRA

Alternative investments such as real estate have always been permitted in IRAs; it even says so right on the IRS website. But few people seemed to know about this option until the last several years.

Below are the primary advantages of investing in real estate with a Roth IRA.

Diversification: Whether it is through retirement investments, such as IRAs or 401(k) plans, or personal savings, many of us have most of our savings connected in some way to the stock market. In fact, over 90% of retirement assets are invested in the financial markets. Investing in non-traditional assets, such as real estate offers a form of investment diversification from the equity markets. In general, the more diversified your portfolio, the greater the chance that your assets will offer lower correlation, meaning they are less likely to move in the same direction.

Invest in Something You Understand: Many Americans became frustrated with the volatility of the equity markets. Many Americans are somewhat shell-shocked from the market swings and not 100% sure what exactly goes on in Wall Street and how it all works. Real estate, for comparison, is easier to understand. Real estate is quickly becoming a mainstream asset category and one of the most trusted asset classes for Americans. Many retirement investors feel more comfortable understanding the real estate market and buying and selling real estate than they do stocks. Many investors feel comfortable with the ability to use their retirement funds to invest in an investment they can understand, such as real estate which provides the potential for asset appreciation and income stream. R

Hard Asset: Many alternative assets, such as real estate, are tangible hard assets that you can see and touch. With real estate, for example, you can drive by with your family, point out the window, and say, “My IRAs owns that”. For some, that’s important psychologically especially in times of financial instability, inflation, or political or global upheaval.

Tax-Free Cash Flow & Gains. Using a Roth IRA to invest in real estate can provide the Roth IRA owner with the ultimate tax shelter: tax-free income or gains, In general, with a Roth IRA all income from the sale of real estate or from rental income would flow back to the retirement account without tax.

Inflation protection: With inflation still impacting the economy in 2024, many retirement account investors have been looking for ways to protect their portfolios from the ravages of inflation. In general, having the ability to invest in certain hard assets, such as real estate or precious metals as seen as a good way to protect your retirement account from inflation.

How to Buy Real Estate with a Roth IRA

In order to buy real estate using a Roth IRA, one must establish a Self-Directed Roth IRA. A Self-Directed Roth IRA is not a legal term that you will find in the Internal Revenue Code. A Self-Directed Roth IRA is essentially an IRA that allows for alternative asset investments, such as real estate or even cryptocurrency. Traditional financial institutions do not allow IRAs or Roth IRAs to invest in IRS-approved alternative assets, such as real estate, because their focus is on earning fees through traditional investments.

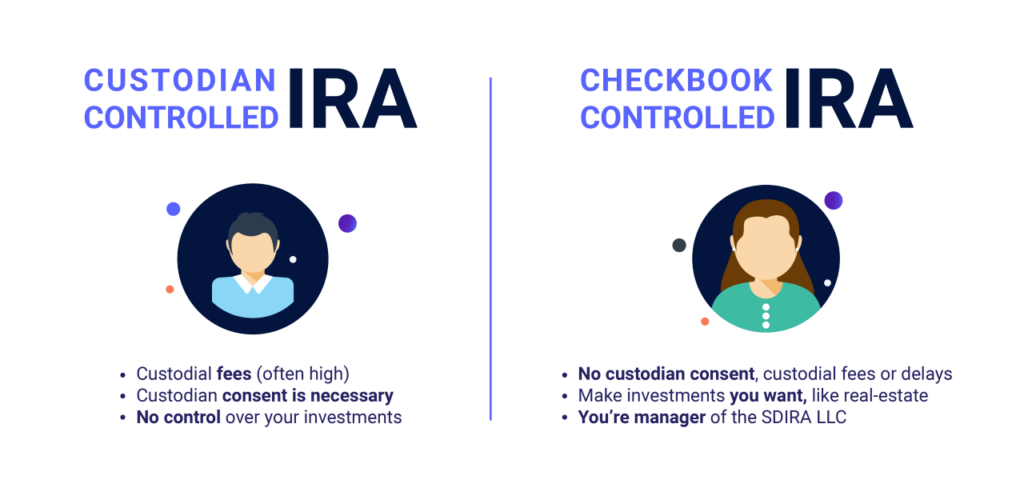

The two primary options for using a Self-Directed Roth IRA to buy real estate are (i) a full-service Self-Directed Roth IRA and (ii) the Self-Directed Roth IRA with “checkbook control.”

- Full-Service Self-Directed Roth IRA

With a full-service Self-Directed Roth IRA, a special IRA custodian, IRA Financial, will serve as the custodian of the Roth IRA. Unlike a typical financial institution which generates fees by selling products and providing investment services, a Self-Directed IRA custodian earns fees by simply opening and maintaining IRA accounts and does not offer any financial investment products or platforms. With a full-service Self-Directed Roth IRA, the Roth IRA funds are generally held with the IRA custodian. The Roth IRA owner will then direct the IRA custodian to invest the Roth IRA funds in IRS-approved alternative asset investments, such as real estate. The title to the Self-Directed Roth IRA asset will be in the name of the Self-Directed IRA custodian care of the IRA owner. For example IRA Financial Trust Company CFBO John Doe Roth IRA. A Self-Directed IRA that is full-service is popular with retirement investors looking to invest in alternative assets that do not involve a high frequency of transactions, such as the purchase of raw land or private fund investments.

- Self-Directed Roth IRA LLC – “Checkbook Control”

With a Self-Directed Roth IRA with checkbook control, a Roth IRA is set up with a Self-Directed IRA custodian, such as IRA Financial. The Roth IRA is then invested into a special purpose limited liability company (LLC), which IRA Financial can help you establish. The Self-Directed Roth IRA LLC is then managed by the Roth IRA owner providing the Roth IRA owner with “checkbook control” over the Roth IRA funds. With a checkbook control Self-Directed IRA LLC, the manager of the IRA LLC will have the authority to make investment decisions without the involvement of the custodian. Plus, a Self-Directed Roth IRA LLC will offer the owner limited liability protection over Roth IRA investments. Moreover, all investments will be titled in the name of the LLC offering you more privacy. With a Self-Directed Roth IRA LLC with checkbook control, you will be able to buy real estate by simply writing a check.

All types of IRAs can be transferred tax free to a Self-Directed IRA LLC. It is popular with IRA investors seeking to invest in alternative assets, such as rental properties, fixes, and flips, tax liens, or cryptocurrencies that require a high frequency of transactions.

Beware of UBIT

In general. almost all retirement account investments generating passive income will not be subject to Unrelated Business Taxable Income (UBTI or UBTI) or Unrelated Debt Finance Income (UDFI) Tax, such as capital gains, interest, dividends, royalties, and rental income.

There are essentially only three types of transactions that could trigger the UBTI tax. Because the maximum UBTI tax rate is 37%, it is important to determine whether your Self-Directed investment will trigger the UBTI before making the investment.

Essentially, the UBTI tax is only triggered if:

- The Self-Directed IRA uses margin or a non-recourse loan to buy stock or an investment asset.

- The Self-Directed IRA invests in an active business through a pass-through entity, such as an LLC; and

- The Self-Directed IRA uses a non-recourse loan to purchase real estate (exemption from the UBIT tax for 401(k) plans). This is known as unrelated debt-financed income (UDFI), which triggers the same UBTI tax.

Hence, in the case of a Self-Directed Roth IRA real estate investment, if a non-recourse loan is used to acquire real estate, a percentage of the income or gains above $1,000 attributable to debt used would trigger the UBIT tax.

Why Use IRA Financial

IRA Financial “literally” wrote the book on the Self-Directed Roth IRA. Our founder, Adam Bergman, Esq, has written nine books on Self-Directed retirement plans and over the last 15+ years has helped over 24,000 Self-Directed clients invest over $3.2 billion in alternative assets.

IRA Financial Self-Directed Roth IRA is specifically designed and customized for each type of investment. Whether it is real estate, private equity, venture capital, hedge fund, private business, cryptos, precious metals, hard money loans or much more, our Self-Directed tax experts will work with you to design the perfect Self-Directed IRA solution for your investment. Additionally, IRA Financial is the only Self-Directed retirement company that provides annual consulting, IRS tax reporting/filings, BOI FinCEN reporting, and full IRS audit guaranty.

See for yourself why IRA Financial is one of the leading providers of Self-Directed IRAs in the country:

- Customized Self-Directed Roth IRA design for your investment

- Flat annual fees

- No transaction or asset value fees

- No wire of check fees

- IRA & 401(k) personalized rollover support

- IRS tax reporting, including IRS Form 5498 & 1099-R

- BOI Reporting with FinCEN

- LLC IRS tax filing (Form 1065) and UBIT tax filings (Form 990-T)

- Free Self-Directed Roth IRA conversion

- Free RMD support

- Free tax research on Self-Directed IRA topics

One-on-one tax support on the “disqualified person” and “prohibited transaction rules.”

- One-on-one tax consultation on UBTI and UDFI rules

- Free access to our best-selling Self-Directed IRA books

- Free access to our educational webinars, podcasts, and newsletters

- Self-Directed IRA IRS audit guaranty

- Free HSA & Coverdell account for year 1 (value of $920)