Investors often look for ways to diversify portfolios and protect wealth against market volatility. One way to achieve this is by investing in gold and other metals, tangible assets that have proven to be a safe haven during times of economic uncertainty. In the following, we’ll discuss why gold can be an excellent alternative investment for your retirement account.

Gold has been considered a valuable asset for thousands of years, and it’s still widely regarded as a store of value and a hedge against inflation. During economic downturns, gold has often outperformed other assets, making it an attractive investment for investors looking for a safe haven.

- Holding gold and other metals in your retirement account provides diversification and a hedge against inflation

- Historically, gold has held its value during times of economic uncertainty

- A Self-Directed IRA allows you to hold any type investments, including IRS-approved metals and coins

Here are some of the reasons why you should consider investing in gold for your retirement plan:

- Diversification: Diversifying your portfolio is essential to reduce the risk of losses. Gold has a low correlation with other assets like stocks, bonds, or other alternatives, like real estate, which means it can help balance your portfolio.

- Protection against inflation: Gold has historically been a hedge against inflation. When inflation rises, the value of currency declines, and the purchasing power of money decreases. Gold, on the other hand, tends to maintain its value and even increase during times of inflation. By investing in gold, you can protect your portfolio against the effects of inflation.

- Portfolio stability: Investing in gold can provide stability to your portfolio and protect your wealth. It can help offset losses which may occur with other assets you are holding.

- Global demand: Gold has a global demand, and it’s traded all around the world. This means that it’s a liquid asset that can be easily bought and sold. It’s liquidity makes it a great option for retirement plans.

- Think long-term: Retirement planning is a long-term investment, as is gold, and its value tends to appreciate over time. The longer you can hold it, the better you’ll be.

Gold vs. the Stock Market

Gold and the stock market have different risk-return profiles and there’s little correlation between the two. Precious metals, including gold, tend to remain steady even as the markets fall.

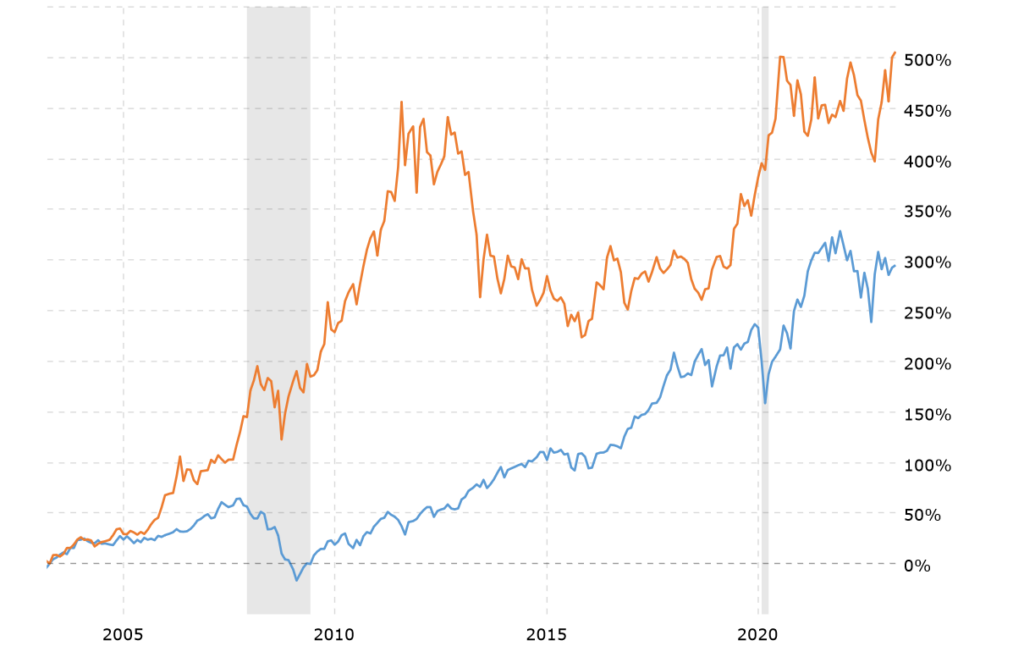

Over the long-term, the stock market has outperformed gold in terms of returns. For example, over the last 50 years, the S&P 500 has generated an average annual return of around 10%. During this same period, the price of gold has increased at an average annual rate of around 4%.

However, it’s important to note that gold has also demonstrated its ability to provide diversification benefits to a portfolio. During periods of economic uncertainty or market volatility, the price of gold has tended to rise, while the stock market has often experienced declines. In the 2008 financial crisis, the S&P 500 fell over 35%, while gold actually increased 25%.

Over the last 20 years, gold has done well compared to the Dow Jones.

Gold is even more valuable during high inflation, like we’ve seen over the last twelve months or so, and currency devaluation. Stocks and other asset classes dwindle, while gold has been used as a hedge during turmoil.

Both asset types should be in everyone’s portfolios specifically for the reasons outlined above. Plus, since both are very liquid, they can easily be bought and solid as one sees fit. Of course, a financial advisor can help decide on the best mix for your individual situation and risk tolerance.

Gold vs. Real Estate

Gold and real estate are arguably the two most popular alternative investments for self-directed retirement savers. While both can provide diversification and potential returns, there are some key differences between the two that investors should consider when deciding which asset to invest in.

Both are great options for your retirement account(s). They’re each tangible asset, meaning you can see and touch it. Obviously, gold is held in the physical form and must be properly stored when using retirement funds. If you own a piece of real estate, you can actually visit it whenever you want, but there is maintenance that needs to be done. When using retirement funds to invest in real estate, you can’t personally be involved, so other fees need to be considered, such as management.

As we mentioned early precious metals are highly liquid and can easily be sold if you need cash. On the other hand, real estate is quite the opposite and could take months to sell depending on the market to free up needed cash.

Gold’s value is based on demand, much like real estate. However, real estate offers flexibility to generate income. Fix and flips can generate income fast in the right situations, while rentals can provide a steady stream.

Both assets have potential to appreciate, however real estate has historically shown higher returns. On the other hand, factors such as local economy and housing crises could diminish the returns you see on a property. Precious metals won’t have as severe fluctuations and have been pretty steady throughout the last few decades.

The decision to invest in gold or real estate with retirement funds will depend on your investment goals, risk tolerance, and financial situation. If you are looking for a highly liquid, low-maintenance asset with potential long-term growth, gold may be a good option. If you are comfortable with the ongoing management and costs associated with real estate, and you are looking for the potential for rental income and higher long-term returns, then real estate may be a better fit.

Investing in Gold with Your Retirement Account

Investing in gold and other metals and self-directing your retirement plan go hand in hand. Generally, if you want to invest in physical metals that are approved by the IRS, you need the right plan with the right custodian. Essentially, you’ll need a Self-Directed IRA. It’s important to keep in mind that not all “SDIRA” providers offer gold as an investment option, so make sure you are working with the right custodian.

Once you find the correct IRA custodian, it’s simply a matter of setting up the account, which the custodian will help you with. If you choose IRA Financial, everything can be done on our app. From there, you need to fund the plan, either via contribution or a rollover of existing retirement funds. Next, it’s time to find the investment you want, whether it’s physical metals, or through metal stocks or ETFs. Make sure you choose a reputable dealer when investing in physical metals.

The gold will be purchased by your IRA, which will generally be facilitated by the custodian. Lastly, you need to store the gold in accordance with IRS rules. You cannot personally hold the metals yourself. They should be held by a third party, such as a bank or depository.

It’s important to note the rules and IRS regulations governing the purchase and storage of gold in a Self-Directed IRA. It’s recommended to work with a financial advisor or IRA custodian experienced in alternative investments to ensure compliance with those rules.

Conclusion

In sum, investing in gold can be an excellent alternative for your retirement portfolio. It can provide diversification, a hedge against inflation, stability, and long-term growth potential. As with any investment, it’s important to do your research and understand the risks involved.

There are many options out there when it comes to using retirement funds to invest in gold. There are some providers that focus solely on metals. They’re often cheaper than full-service IRA custodians, but you are limited to just that one asset class. On the other hand, IRA Financial puts no limitations on what you can invest in. Yes, we’re more expensive than “Gold Only” IRA providers, however, you have the ability to invest in anything you want, with an all-in-one account, whether it’s gold, real estate, mutual funds, cryptos or anything else that is not a prohibited investment.

At the end of the day, if you want to properly diversify your portfolio, you should spread your retirement funds across several asset classes and the best way to do that is with an IRA Financial Self-Directed IRA!