Buy, sell, and trade the most popular cryptocurrencies tax free, with the new IRAfi Crypto™ platform.

Featured on:

A New Way to Invest in Cryptos

- Included with All IRA & 401(k) Accounts

- Invest Directly with Your Retirement Account

- No Need for an LLC

- New Partnership with Bitstamp

- Buy, Sell & Trade Instantly 24/7/365

- We Do All IRS Reporting

Pricing

- Crypto-Only Account

- No Setup Cost

- 1% custodial/recordkeeping fee per trade

- $10 minimum per trade

- Limit Trading Now Live

- Upgrade to a Full Self-Directed IRA or IRA LLC at any time

Benefits of Investing with Retirement Funds

Tax-Free Gains

All income and gains from your crypto investments flow back into your retirement plan without tax

Ignore Holding Periods & Basis

No need to worry about holding periods and figuring out short- and long-term capital gains since your investments are not subject to tax

Diversification

Diversify your retirement portfolio by investing in an emerging asset class

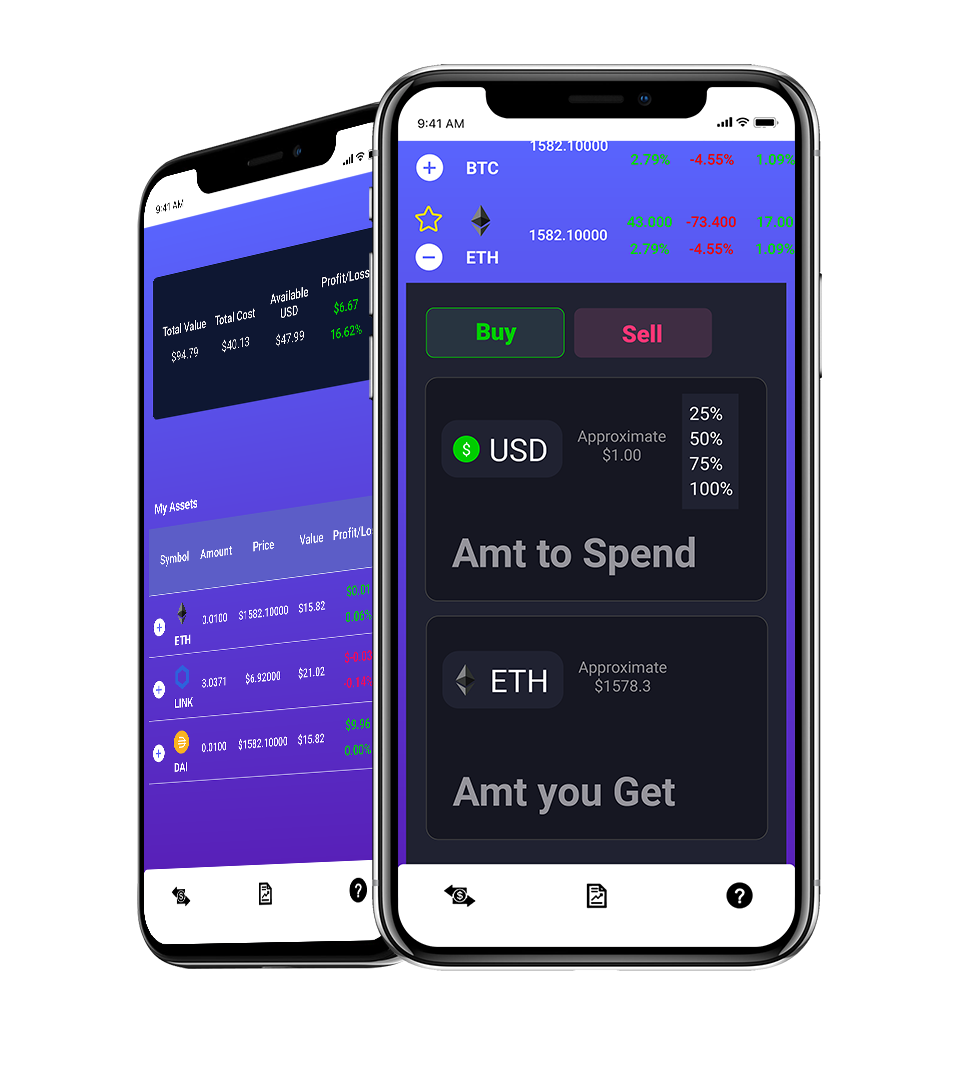

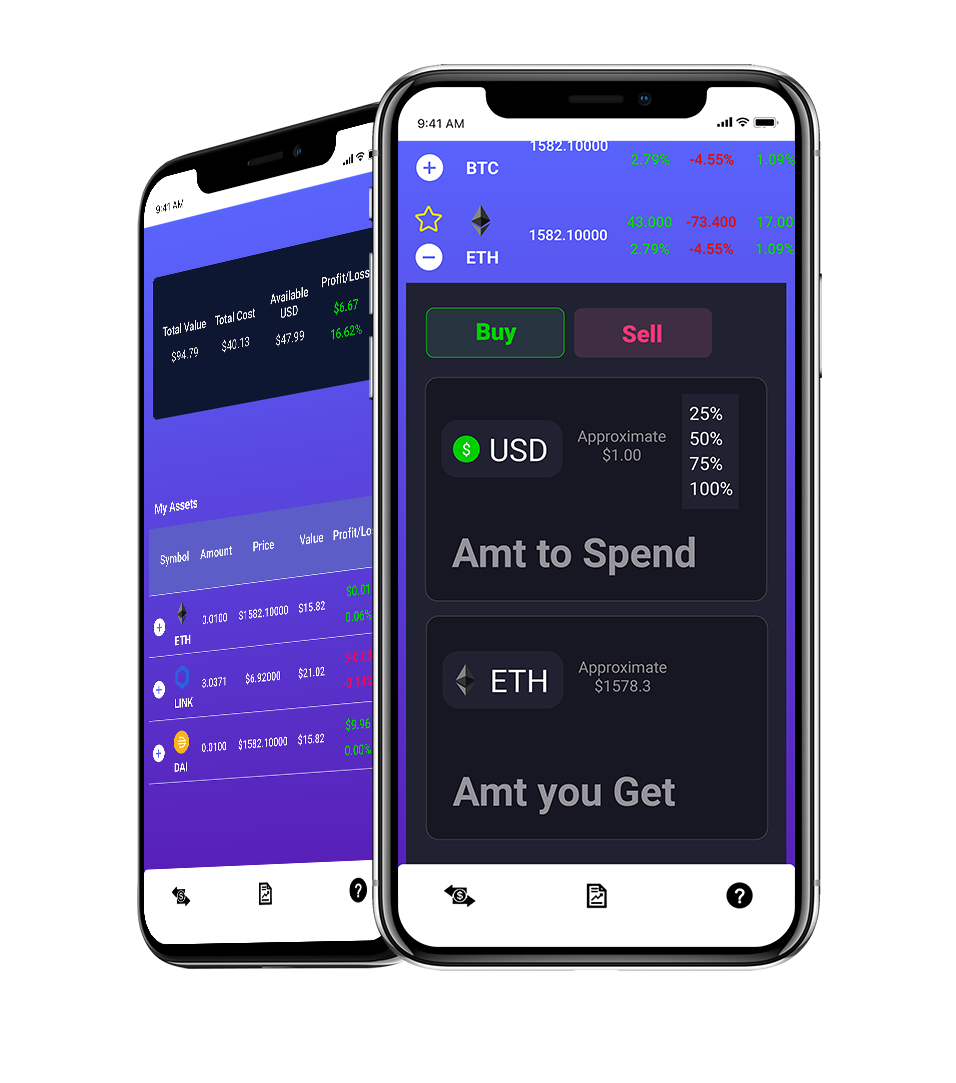

Our New App

- Dedicated App for Crypto Traders

- Available on Apple, Android & Desktop

- Prices Updated in Real Time

- Concise Buy/Sell User Experience

- Comparative Analysis Tool

- Trade 35 Tokens

- Educational Links for Each Coin

- Total Value & Profit/Loss at a Glance

Getting Started is Easy

1. Begin the process

Fill out our quick app to get started today!

2. We’ll get in touch

A self-directed specialist will work one-on-one with you to finish the application - we'll be with you every step of the way!

3. Start investing

Fund your account and invest in your future!

Security is Our Top Priority

About Our

New Partner

Bitstamp is the oldest and most reputable cryptocurrency exchange in the industry and has been operating since 2011.

Bitstamp is regulated by the New York State Department of Financial Services (NYDFS).

Bitstamp uses 2FA, SSL encryption and cold storage for most of their crypto holdings, and have a dedicated security team working around the clock to prevent and respond to security attacks.

Note: IRA Financial does not offer a cold wallet solution at this time.

Robinhood to Acquire Bitstamp

This acquisition will bring Bitstamp’s globally-scaled crypto exchange to Robinhood, with retail and institutional customers across the EU, UK, US and Asia.

This strategic combination better positions Robinhood to expand outside of the US and will bring a trusted and reputable institutional business to Robinhood.

Expected to close in the first half of 2025, subject to customary closing conditions, including regulatory approvals.

Custody at

Bitstamp

Bitstamp safeguards your assets in cooperation with our partner custodian BitGo.

They provide secure safekeeping of and access to funds and offer both hot wallets and cold custodial wallets. Many of their clients keep a portion of their funds in hot wallets for greater liquidity and the rest in cold storage for maximum security.

All the wallets held there have their keys divided into multiple pieces, held in different locations, and several of these are required to sign any transaction. This means an attacker would need to compromise the majority of them in multiple locations in order to gain control of one of these wallets.

BitGo’s custodial wallets are provided by four regulated trust companies, each of which serve as a qualified custodian. They also maintain up to $250M in insurance coverage against loss, theft and misuse.

BitGo is backed by Goldman Sachs, Craft Ventures, Digital Currency Group, DRW, Galaxy Digital Ventures, Redpoint Ventures, and Valor Equity Partners.

The IRA Financial Difference

24,000+ clients

Our tax and ERISA experts have helped over 24,000 clients in all 50 states.

No hidden fees

No transaction or asset value fees. No minimum balance requirement (with credit card on file).

Serve as your custodian

Holds over $3.2 Billion in alternative assets.

Expertise

IRA Financial’s founder, Adam Bergman, is the author of nine books on self-directed retirement.

Dedicated support

Get direct access to a self-directed retirement expert to establish your plan.

Technology

Use our app to set up and maintain your account.

Quick FAQ & Further Reading

- Direct Contribution

- IRA Transfer

- Rollover of Previous Employer 401(k) Funds

No! IRA Financial is unique in that we do not require a minimum deposit to get started or maintain a minimum balance as long as you have a credit card on file.

Since retirement plans are tax-advantaged accounts, you don’t need to worry about taxes, such as capital gains, when you trade cryptos inside one. With a traditional plan, taxes are deferred until you withdraw from the plan; if you utilize a Roth, never pay taxes on qualified distributions.

The main difference between the two types of plans is when you pay taxes. A traditional IRA is funded with pretax money, meaning you get an upfront tax break. Taxes are deferred until you withdraw from the plan. A Roth IRA is funded with after-tax money, therefore there is no immediate tax benefit. However, all qualified withdrawals are tax free.

Transfers occur between like accounts (IRA to IRA), while a rollover is from a different account (401(k) to IRA). A direct transfer or rollover goes directly from one custodian to another. An indirect transfer or rollover goes to you first. You then have 60 days to contribute the funds to a new plan.

You may choose a traditional or Roth Self-Directed IRA, SEP & SIMPLE IRAs for small businesses, Solo 401(k) if you are self-employed, HSA (Health Savings Account), or Coverdell ESA (Education Savings Account)

- It is designed for the Novice and Intermediate trader that wants to get started without first mastering a complex trading platform.

- It has a unique profit and history tracking tool that allows users to have a clear picture of their activities and the outcomes.

- It has direct education links from each coin to popular education sites like CoinMarketCap to help users learn more about coins to invest in.

- It provides real time pricing and profit/loss trends on-screen that other popular trading platforms do not offer.

Limit trading is now live on the app! A limit order is a direction to purchase or sell a crypto at a specified price or better. This feature allows retirement account investors to better control the prices at which they trade. A limit can be placed on either a buy or sell order:

- A buy limit order will be executed only at the limit price or lower.

- A sell limit order will be executed only at the limit price or higher.

Not at this time. However, IRA Financial has been working on a multi-signature wallet solution that will comply with IRS rules and the McNulty case ruling that will allow retirement account owners to hold their cryptos off the exchange on a cold wallet in which they personally hold. We are hoping this solution will be live in the near future.

In order to invest in other assets such as real estate and precious metals, you need to upgrade your account to a full-service Self-Directed IRA or Solo 401(k) plan. Simply log into the app, and choose which type of plan you want.

IRAfi Crypto™ does not support all cryptocurrencies; it does support most of the major cryptocurrencies including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, XRP, etc. See the full list here.

If you wish to invest in a crypto not supported by our app, you can set up a Self-Directed IRA LLC and use an exchange of your choice. You would purchase cryptos in the name of the LLC and control the entire process on your own without the need for expensive brokers.

IMPORTANT DISCLAIMER

IRA Financial Trust Inc. and IRA Financial Group, LLC (“IRA Financial”) are not an exchange, funding portal, custodian, trust company, licensed broker, dealer, broker-dealer, investment advisor, investment manager, or adviser in the United States or elsewhere. IRA Financial is not affiliated with & does not endorse any particular cryptocurrency, precious metal, or investment strategy. IRA Financial is solely a technology platform providing access to cryptocurrency investments via Bitstamp cryptocurrency exchange.

Cryptocurrencies are a speculative investment with risk of loss. Staking involves considerable risk. Cryptocurrency is not legal tender backed by the United States government, nor is it subject to Federal Deposit Insurance Corporation (“FDIC”) insurance or protections. Users do not receive a choice of custody partner. The self-directed purchase and sale of cryptocurrency through a cryptocurrency IRA have not been endorsed by the IRS or any regulatory agency. Historical performance is no guarantee of future results.

IRA Financial makes no guarantee or representation regarding investors’ ability to profit from any transaction or the tax implications of any transaction. IRA Financial does not provide legal, investment or tax advice. Consult a qualified legal, investment, or tax professional.

Information contained on this website is for information purposes only. It is not tailored to any specific user. It does not constitute investment advice in any way, nor does it constitute an offer to sell or a solicitation of an offer to buy or sell any cryptocurrency or security or to participate in any investment strategy. IRA Financial. makes no representation or warranty as to the accuracy or completeness of this information and shall not have any liability for any representations (expressed or implied) or omissions from the information contained herein. IRA Financial disclaims any and all liability to any party for any direct, indirect, implied, punitive, special, incidental or other consequential damages arising directly or indirectly from any use of this information, which is provided as is, without warranties.