Self-directing has never been easier

- Invest tax free in alternative assets.

- We open your self-directed bank account, handle all IRS reporting, and offer annual IRS compliance services.

- Better diversify your retirement investments.

- No account value fees or minimum balance (with credit card on file).

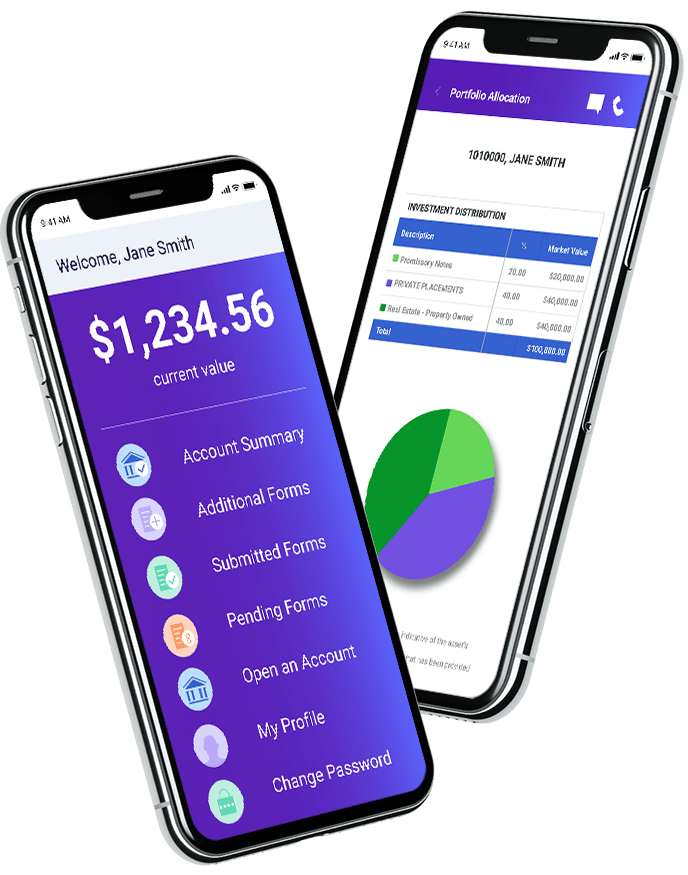

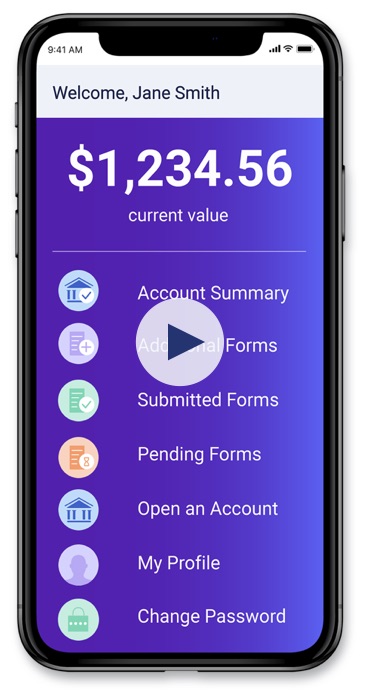

Do everything on our app

1. Open an account

Sign up in minutes with our app and open a Self-Directed IRA account or call us at 800-472-0646.

2. Roll over funds

You can perform a tax-free direct rollover or indirect rollover to a passive custodian like IRA Financial Trust.

3. Invest

Invest in alternative assets like real estate, as well as traditional assets like stocks.

24,000+ Clients

Our tax and ERISA experts have helped over invest $3.2 billion in alternative assets.

9 Books

Our founder, Adam Bergman, is the author of nine books on self-directed retirement plans.

Dedicated Support

Our team of specialists will work with you to help you establish the right self-directed retirement account.

Our fees

Our fees are simple and transparent.

What you can invest in

With a self-directed account, you can make almost any type of investment and generate tax-free gains.

Download our info kits to learn more about self-directed retirement

Robust, easy to read, and updated for 2024. This guide is your one-stop shop for all the most important questions about self-directed retirement.