The Gold IRA | Gold Backed IRA

In times of financial uncertainty, gold is an attractive option; learn how to use a tax-advantaged retirement account to invest.

Gold price by GoldBroker.com

What is a Gold IRA?

A Gold IRA refers to a Self-Directed IRA that allows individuals to invest in gold and other precious metals. An “SDIRA” is a specialized individual retirement account that allows you to invest in traditional investments, like stocks and mutual funds, and alternative assets such as gold, precious metals, real estate, and more.

A Gold IRA is similar to a traditional investment account. The contribution limits, distribution & rollover rules, and prohibited transaction rules remain the same. The only difference is what you can invest in.

Understanding Gold-Backed IRAs

Gold-backed IRAs are retirement accounts that allow individuals to save money for retirement by investing in precious metals and coins. Gold-backed IRAs are commonly referred to as Precious Metal IRAs. These accounts have multiple tax advantages, which vary based on account types. Gold IRAs can be a traditional IRA, Roth IRA, or SEP IRA. The main difference is that they must be a Self-Directed IRA. Individuals can also hold gold in a Self-Directed Solo 401(k). To set up a Gold IRA, you need a Self-Directed IRA custodian, such as IRA Financial, which allows individuals to invest in all types of asset classes.

The Self-Directed Gold IRA custodian handles the documentation and reporting requirements to ensure the account remains compliant with IRS rules and regulations. However, it is important to note that not all Self-Directed IRA or Solo 401(k) custodians offer the same types of assets. For example, at IRA Financial, individuals can also invest in real estate, private companies, cryptos and more! Other Gold IRA providers only allow individuals to invest in gold or cryptos. Even though you may have a specific interest in gold, diversifying your portfolio across multiple asset classes is equally important.

Why Invest in Gold?

Since the Gold Rush of 1849, people have clamored to get their hands on the precious metal. People often rush to gold, and other metals, in times of economic downturns. It’s always been considered a “safe” investment. Apart from a few hiccups, gold has gone up since the turn of the century. The benefits of investing in gold include:

Diversification

Purchasing gold and other precious metals in a retirement account allows you to diversify your portfolio. Diversifying your portfolio is essential to reduce the risk of losses. Gold has a low correlation with other assets like stocks, bonds, or other alternatives, like real estate, which means it can help balance your portfolio.

Liquidity

Gold has a global demand, and it’s traded all around the world. This means that it’s a liquid asset that can be easily bought and sold. It’s liquidity makes it a great option for retirement plans.

Inflation Protection

Gold has historically been a hedge against inflation. When inflation rises, the value of currency declines, and the purchasing power of money decreases. Gold, on the other hand, tends to maintain its value and even increase during times of inflation.

Stability

Gold is one of the most stable investments. Yes, it has had its down years, but the overall picture is quite clear that gold tends to retain its value. The price of gold has increased over 50% over the last five years.

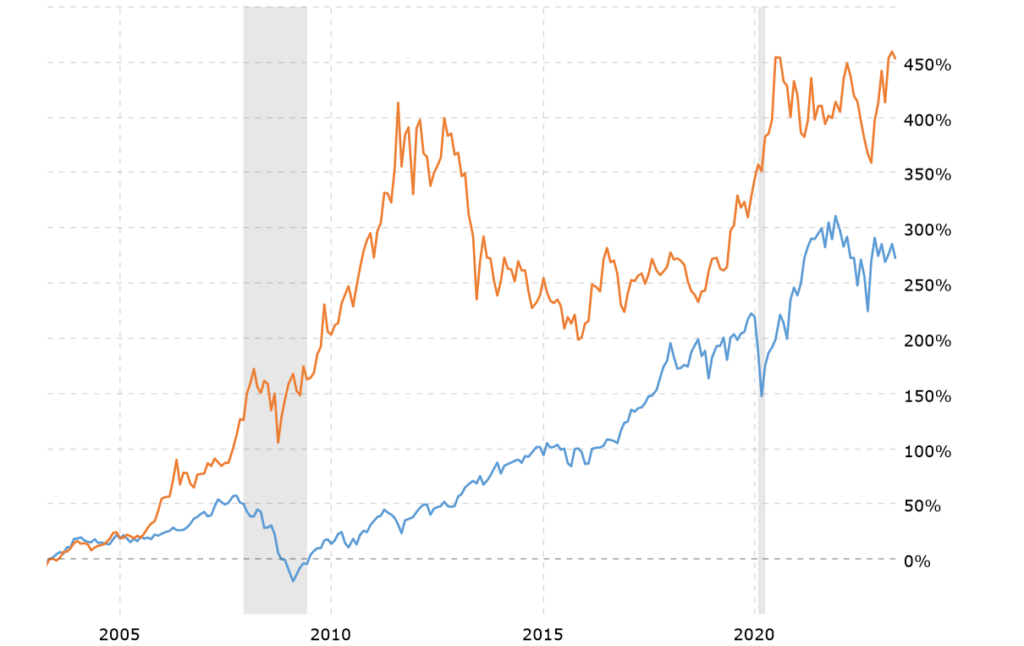

Gold Price vs. Stock Market

IRS-Approved Metals & Coins

The Internal Revenue Code (IRC) prohibited investments in most collectibles. However, there are exceptions for certain metals and coins. The following coins and metals are not included in the definition of “collectible” under IRC Section 408(m):

- Certain gold, silver, or platinum coins described in 31 USC Section 5112. See IRC Section 408(m)(3)(A) for the full definition.

- Any coin issued under the laws of any state.

- Any gold, silver, platinum, or palladium bullion of a certain fineness if a bank or approved non-bank trustee keeps physical possession of it. See IRC Section 408(m)(3).

Tips for Buying Gold in an IRA

- Spend time researching gold dealers before making a decision.

- Understand how gold is priced before you agree to buy it.

- Ask for references from friends or trusted sources before choosing a gold dealer. (IRA Financial has several gold companies it works with.)

- Make sure the gold bullion or coin is of the correct finesse as required by IRC 408(m).

- Do not hold the IRA-owned metals at home; they should be held at a depository.

FAQs

Internal Revenue Code 408(m) states that IRS-approved metals and coins must be held “in the physical possession of a trustee described under subsection (a) of this section.” Therefore, you should never store your IRA-owned gold personally.

Yes! IRA Financial does not limit your investment options with our self-directed retirement plans. There are only three things you cannot invest in, as per the IRS: life insurance, collectibles, and any transaction involving a disqualified person. Apart from those, you can invest in anything you want with IRA Financial, including real estate, cryptos, private equity and so much more.

Generally, a typical, workplace 401(k) will NOT allow for alternative investments, including gold. However, if you are self-employed with a Solo 401(k) and your plan provider allows for it, you CAN invest in IRS-approved metals and coins.

No! All gains associated with the sale of gold and other metals held inside your retirement plan are NOT subject to tax. Taxes are only due once you withdraw the funds (or metals) from the plan. Note: qualified Roth distributions are NEVER taxable!

Yes! If you wish to make an in-kind rollover of gold from one retirement account to another (or distribute the physical metal), you can. Direct rollovers are a tax-free event, while distributions would incur tax based on the price of the metal at the time of withdrawal.